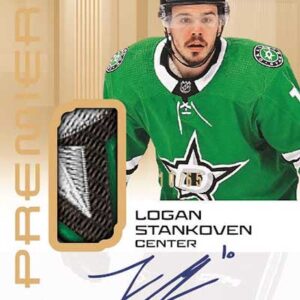

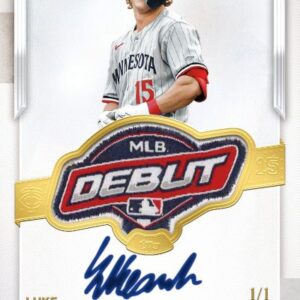

In a world where the value of a single sports card can sky-rocket faster than a hockey puck at a Stanley Cup final, Canadian sports memorabilia collectors have long navigated the risky waters of inadequate insurance coverage. No more, says NFP, a leading North American insurance broker, which, in tandem with Berkley Asset Protection, has unfurled a specialized insurance program designed to safeguard these prized collections.

Collecting sports memorabilia isn’t just a hobby; it’s an investment requiring significant financial outlay. The standard homeowners’ policies many rely on are often ill-equipped to cover the full value of high-ticket items like vintage hockey jerseys or autographed baseballs. Recognizing this coverage shortfall, Greg Dunn, Managing Director of Personal Risk at NFP in Canada, pointed out that the new insurance program is crafted to fill these gaps, offering collectors comprehensive protection from the moment they acquire a new piece.

“One can hardly overstate the comfort that comes from knowing your latest prized possession is protected as soon as you acquire it,” Dunn commented. This sentiment is at the heart of the new initiative which includes automatic coverage for new acquisitions and transit coverage, thus greatly mitigating the risk associated with transporting collectibles, which can be a high-stake scenario, especially for transcendentally valuable items.

Olivia Cinqmars-Viau, AVP of fine art underwriting at Berkley Asset Protection, elaborated on the custom approach they’ve taken, tailoring the insurance solutions to meet the nuanced needs of collectors. This level of customization is vital in a hobby where the emotional value is often matched—and occasionally dwarfed—by financial value. The insurance is designed not as a one-size-fits-all cover, but as a bespoke shield, crafted in the awareness of the collector’s unique needs and the specific risks faced by sports memorabilia.

Echoing these sentiments, Steve Menzie, the President and owner of the Sport Card & Memorabilia Expo—Canada’s largest showcase of sports collectibles, expressed his endorsement of the NFP initiative. According to Menzie, while collectors often consider their collections priceless, the financial realities can’t be ignored. “It’s about securing an investment,” Menzie said. He noted that this program should encourage collectors to keep pursuing their passions with an enhanced sense of security concerning their financial outlay.

The unveiling of this innovative insurance program will take place at the upcoming Sport Card & Memorabilia Expo in Toronto, adding an extra layer of excitement to the event. Scheduled from April 25-28, the expo will serve as a perfect backdrop for NFP’s Personal Risk team to educate attendees on the benefits and intricacies of this new offering. It’s a strategic move not just to introduce the program but to immerse it in the community it aims to serve.

This initiative is reflective of NFP’s broader commitment to addressing unique, niche markets in the insurance landscape. Investing more than just funds, NFP brings an understanding of the personal value and emotional connections tied to collectors’ items. With over 1,000 staff in Canada and an additional 7,000 globally, their expansive reach and deep resources allow them to provide personalized, local-friendly services coupled with comprehensive international expertise.

For Canadian collectors of sports memorabilia, NFP’s new insurance program is more than just a policy—it’s a promise of protection, a gesture of understanding, and a tool enabling them to keep chasing their passions without pause. Amidst the fast-paced, high-stakes world of sports memorabilia collecting, this promise of peace of mind might just be the most valuable collectible of all.